Did companies try to maintain stable leverage ratios?

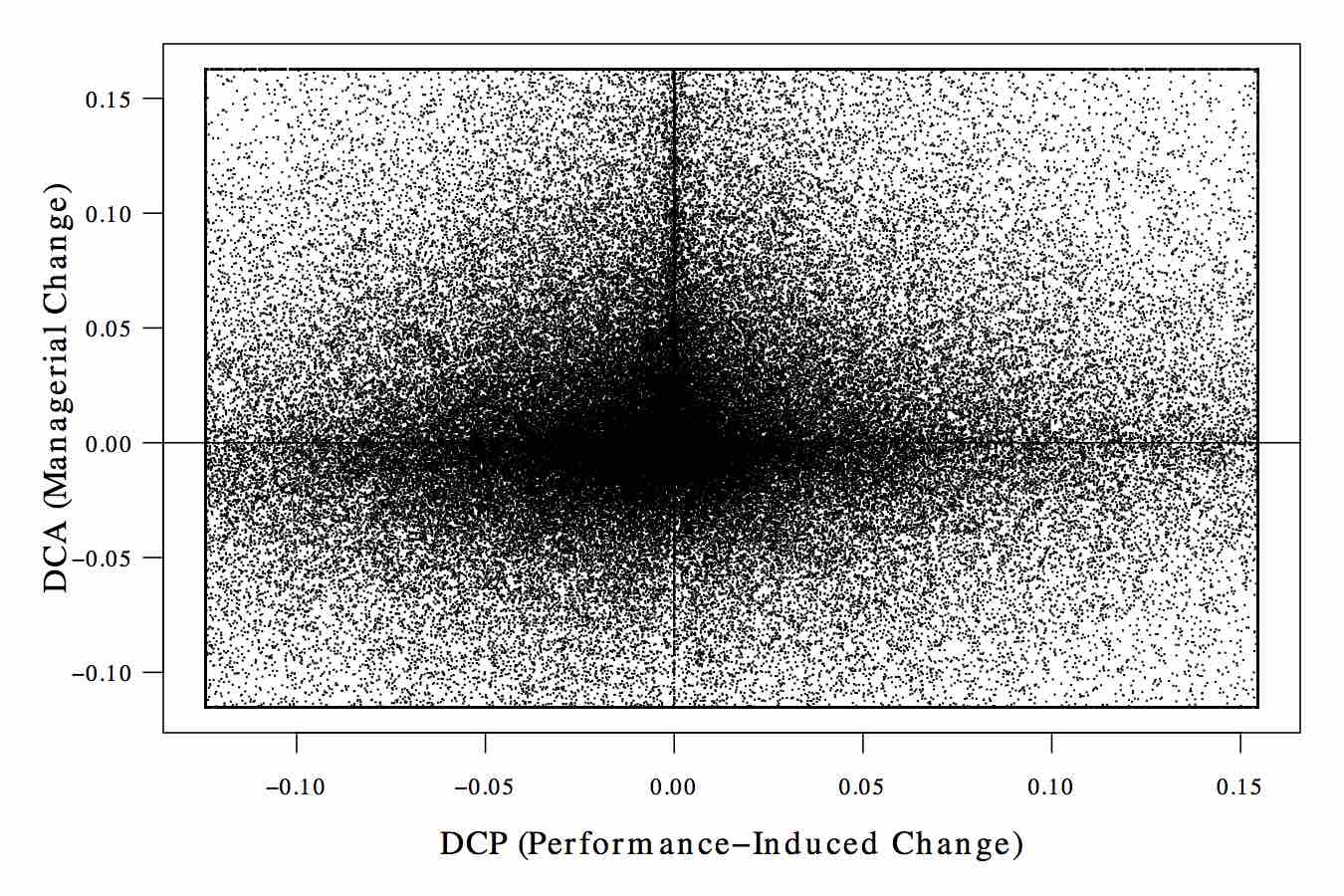

The x-axis are leverage ratio changes caused by stock returns (equity value changes). The y-axis are managerially-induced leverage ratio changes (such as issuing activity). If managers wanted to target a leverage ratio, we should see a strong negative correlation between the two.

Ergo: Managers of publicly-traded companies behave as if they do not target a leverage ratio.

https://ssrn.com/abstract=489664. https://cfr.pub/published/

PS: Also look at Common Problems in Capital Structure Research.